Insurance for New Immigrants in Canada 2025

Introduction

When moving to Canada, one of the first questions newcomers ask is: “What about healthcare?” Canada is famous worldwide for its public healthcare system, but new immigrants are often surprised to learn that coverage doesn’t start right away. Depending on your immigration status and the province where you settle, you may need to arrange private health insurance to cover the first few months.

In this guide, we’ll explain the healthcare options available for newcomers, tourists, and temporary residents. We’ll cover waiting periods, costs, private plans like Manulife insurance for visitors to Canada, and practical tips to make sure you and your family stay protected from day one.

1. Do New Immigrants to Canada Get Free Healthcare?

Canada’s healthcare system is publicly funded, but it is managed at the provincial level. This means eligibility and coverage rules depend on where you live.

Understanding the Basics

- Permanent residents and some temporary residents can access public healthcare.

- However, many provinces have a waiting period of up to three months before newcomers become eligible.

- During this time, you are responsible for your own medical expenses unless you have private insurance.

Learn more on the Government of Canada website.

Why Private Insurance is Essential

Medical costs in Canada can be very high without coverage. For example, an emergency hospital visit can easily cost thousands of dollars. To protect yourself, most newcomers purchase health insurance for visitors to Canada or temporary plans like Manulife insurance for visitors to Canada to bridge the gap until provincial healthcare kicks in.

Book Your Consultation Session →

2. How Long Do You Have to Live in Canada to Get Free Healthcare?

Most provinces have a waiting period of up to 3 months before your government health coverage begins. During this time, you are expected to arrange private health insurance to cover medical expenses.

For example:

- Ontario, British Columbia, and Quebec typically require a 3-month wait.

- On the other hand, provinces like Alberta, Manitoba, Nova Scotia, New Brunswick, and Prince Edward Island provide instant coverage from the day you establish residence.

Check Ontario Health Coverage rules.

Provincial Healthcare Waiting Periods

| Province / Territory | Waiting Period | What You Should Do |

|---|---|---|

| Alberta | None | Apply for your health card immediately upon arrival. |

| Manitoba | None | Coverage begins once you establish residence. |

| Nova Scotia | None | Register as soon as you land. |

| New Brunswick | None | Health coverage starts right away. |

| Prince Edward Island | None | Apply early to avoid delays in receiving your card. |

| Newfoundland & Labrador | None | Immediate coverage upon registration. |

| Ontario | Up to 3 months | Get private insurance to cover emergencies until OHIP begins. |

| British Columbia | Up to 3 months | Apply quickly; buy short-term insurance. |

| Quebec | Up to 3 months | Temporary health insurance is strongly recommended. |

| Saskatchewan | Up to 3 months | Private insurance is required for the waiting period. |

| Northwest Territories | Up to 3 months | Ensure you apply on arrival. |

| Yukon | Up to 3 months | Private coverage recommended. |

| Nunavut | None | Coverage starts immediately. |

What You Should Do During This Time

- Apply for your provincial health card as soon as you arrive.

- Purchase temporary private health insurance to cover emergencies and doctor visits until your public coverage starts.

- Keep all your immigration and address documents ready, they are required when registering.

What About Temporary Residents?

International students, temporary foreign workers, and tourists usually do not qualify for provincial healthcare right away. They need to arrange health insurance for tourists in Canada or a private plan tailored to their stay.

If you are planning to study in Canada, universities often require proof of private insurance before classes begin.

3. How Much Does Canadian Health Insurance Cost?

Healthcare in Canada is funded by taxes, but newcomers often need private insurance before becoming eligible for public coverage.

Public Healthcare Costs

Public healthcare is free at the point of service, but it does not cover everything. Services like:

- Dental care

- Prescription medications

- Vision care

- Ambulance services

…are often excluded and must be paid out-of-pocket or through additional insurance.

Learn about coverage limitations on the Canada Health Act.

Private Insurance Costs for Newcomers

Private insurance varies depending on your age, health, and the type of coverage you choose. On average:

- Basic plans: $50–$100 CAD per month.

- Comprehensive plans: $150–$200 CAD per month.

If you’re arriving as a visitor, you can buy health insurance for tourists in Canada or specialized plans such as Manulife insurance for visitors to Canada. These policies cover emergencies, hospital stays, and in many cases, prescriptions.

4. Can a Foreigner Get Health Insurance in Canada?

Yes, foreigners in Canada, including tourists, students, temporary workers, and new permanent residents in waiting periods, can buy private health insurance to cover medical expenses. Since not all newcomers immediately qualify for free provincial healthcare, private insurance ensures you’re protected from unexpected costs like hospital visits, prescriptions, or emergency care.

Foreigners who don’t yet qualify for public healthcare must rely on private insurance during their stay. Coverage depends on the type of visa and length of stay:

- Tourists & Visitors: Must purchase visitor insurance to cover emergencies. Without it, medical bills can be very expensive.

- International Students: Many provinces require proof of private health insurance before granting a study permit. Some universities include this coverage in tuition.

- Temporary Workers: Some provinces allow workers with permits over 6–12 months to apply for provincial healthcare, but many still need private coverage during the waiting period.

- New Immigrants: Even if eligible for public health insurance later, most must purchase temporary private coverage during the waiting period (0–3 months depending on the province).

In short: Yes, foreigners can get health insurance, but usually only through private providers until they become eligible for provincial plans.

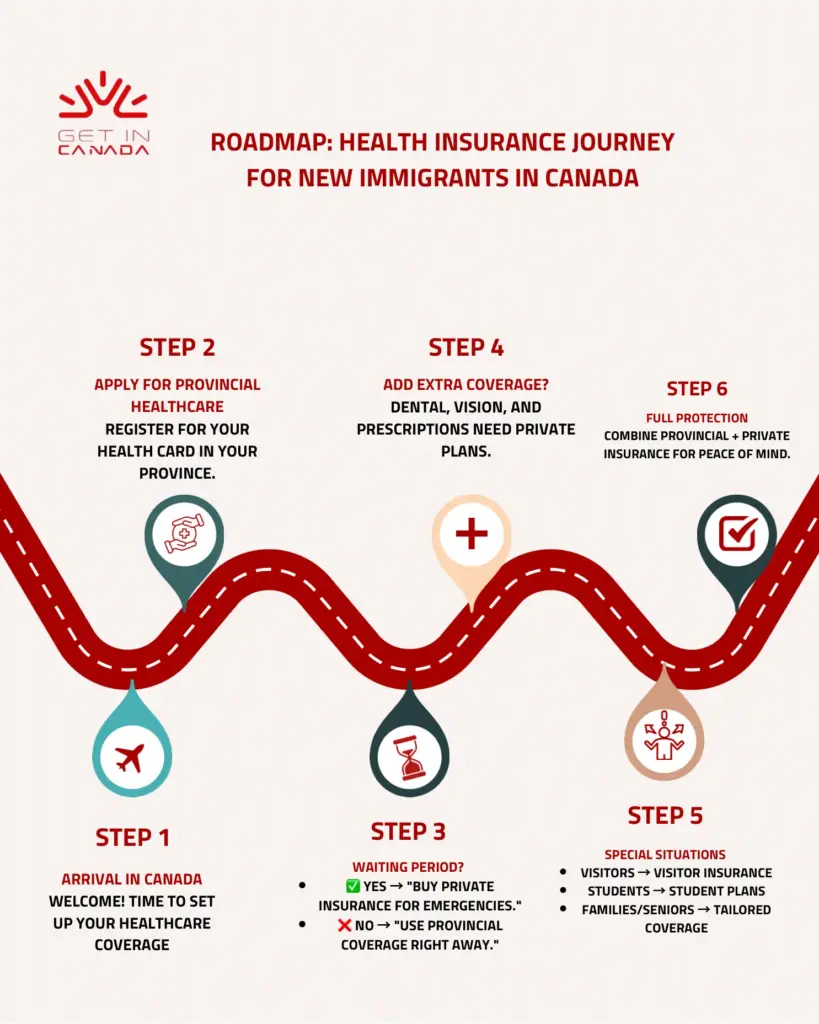

Here’s a step-by-step roadmap to navigating health insurance as a newcomer in Canada:

5. Best Insurance Options for New Immigrants

Finding the right health insurance in your first months in Canada can feel overwhelming, but with the right choices, you’ll be fully protected until your public healthcare kicks in. The best option depends on your immigration status, family situation, and how long you’ll wait for provincial coverage. Below are the most reliable paths:

Types of Insurance for New Immigrants in Canada

- Provincial Healthcare

Public healthcare system that covers essential medical services like doctor visits and hospital care, but excludes dental, vision, and prescriptions. - Private Health Insurance

Bridges the gap during provincial waiting periods or covers what public plans don’t, such as dental, vision, and prescription drugs. - Employer-Sponsored Health Insurance

Many Canadian employers offer extra benefits like dental, vision, and extended drug coverage on top of public healthcare. - Health Insurance for Visitors to Canada

Short-term protection for tourists and temporary visitors against high emergency medical costs, hospital stays, or ambulance fees. - International Student Health Insurance

Special plans for international students that cover emergencies, doctor visits, and sometimes prescriptions while studying in Canada. - Manulife Insurance for Visitors

A well-known option offering flexible, reliable coverage for visitors, protecting against unexpected medical emergencies and trip risks. - Family and Senior Insurance Plans

Tailored for dependents and seniors, ensuring affordable emergency coverage and age-specific health needs.

Quick Comparison at a Glance

| Type of Insurance | Who It’s For | Coverage Highlights | When to Apply / Extra Notes |

|---|---|---|---|

| Provincial Healthcare | Eligible immigrants & Permanent Residents (PRs) | •Family doctors Specialists • Lab tests • Emergency care • Surgeries | Apply immediately after eligibility (may take 0–3 months depending on province) |

| Private Health Insurance (e.g., Manulife Visitors to Canada) | New PRs waiting for provincial coverage, sponsored family, visitors | •Emergency hospital visits • Doctor consultations • Prescription drugs (plan-dependent) • Accident & injury | Apply before or right after landing in Canada |

| Tourist Insurance | Short stays (vacation, family visits) | •Emergency care • Hospitalization • Urgent prescriptions | Protects against high medical bills |

| Visitor / Super Visa Insurance | Parents & grandparents (Super Visa), long stays | •Min. $100,000 coverage • Emergency care • Hospitalization • Repatriation | Mandatory for Super Visa applicants |

| International Student Plans | Students at Canadian universities/colleges | • Doctor visits • Emergency care • Medications (varies by school) | Upon admission / before starting studies |

| Employer-Sponsored Benefits | Immigrants employed in Canada | • Dental care • Vision care • Prescription drugs • Physiotherapy & paramedical services | After job contract begins (check with HR) |

| Family & Senior Plans | Families immigrating together, parents, grandparents | • Family-wide coverage • Senior health services • Some pre-existing condition coverage (plan-dependent) | Apply before or during sponsorship/arrival |

| Manulife Visitors to Canada | Tourists, visitors, students | • Emergency care (up to $1M) • Dental emergencies • Diagnostic tests • Repatriation | Flexible plans, trusted provider |

Pro Tip: Always compare insurance plans. Coverage depends on province, stay duration, and provider.

6. Pro Tips for Choosing Insurance

- Compare coverage and deductibles before buying.

- Don’t go without insurance even for a few weeks.

- Check for pre-existing condition coverage, especially for seniors or visitors.

- Use official resources like settlement agencies, Manulife, or Volunteer Canada to explore your options.

7. Conclusion

Settling in Canada is exciting, but it’s important to stay protected. While public healthcare is one of the country’s biggest benefits, new immigrants often need private insurance at first. Options like health insurance for tourists in Canada, health insurance for visitors to Canada, and Manulife insurance for visitors to Canada make the transition smoother and safer.

Remember: securing health coverage is one of the first steps to building a stable and stress-free life in Canada. For expert guidance on immigration, settlement, and insurance options, Get In Canada is here to help every step of the way.