Practical Tips to Save Money in Canada as a Newcomer in 2025

Moving to a new country is exciting, but it comes with financial challenges. If you’re a newcomer, learning how to save money Canada newcomers need is essential for building stability. From finding cheap housing Canada students depend on to discovering ways to save money groceries Canada, planning your budget wisely will help you avoid stress and enjoy your new life.

This guide explores practical money-saving strategies: affordable housing, food budgeting, transportation discounts, scholarships, part-time work, and hidden costs. With real examples, tables, and resources, you’ll learn how to thrive in Canada without overspending.

1. Save Money in Canada for Newcomers

Arriving in a new country often comes with excitement, but also financial stress. Many save money Canada newcomers goals fail because they underestimate everyday costs such as rent, utilities, food, and even mobile phone plans.

Quick tips to get started:

- Open a free student bank account and avoid hidden fees.

- Buy used furniture or electronics through platforms like Kijiji or Facebook Marketplace.

- Compare prices using Flipp before shopping for groceries or household items.

Remember: The first few months are the most expensive. Having an initial budget will help you adjust faster.

➡️ Let’s begin with the largest expense: housing.

2. Finding Affordable Housing as a Student

Housing consumes the biggest part of your budget. For newcomers, choosing affordable rent Canada newcomers can afford is critical. International students often struggle in cities like Toronto and Vancouver, where prices are higher than average.

Average Monthly Rent in 2025:

| City | Shared Room (CAD) | 1-Bedroom Apartment (CAD) |

|---|---|---|

| Toronto | 700–900 | 1,700–2,200 |

| Vancouver | 750–950 | 1,800–2,400 |

| Calgary | 500–700 | 1,200–1,600 |

| Halifax | 550–750 | 1,300–1,700 |

(Source: CMHC Housing Market Reports)

Tips to reduce rent:

- Consider smaller cities like Calgary or Halifax for cheap housing Canada students can rely on.

- Share an apartment or basement suite with other newcomers.

- Check your university’s residence and housing boards before relying on private rentals.

Read More: Affordable Housing in Canada

➡️ After rent, your second biggest monthly expense will be groceries and food.

Book Your Consultation Session →

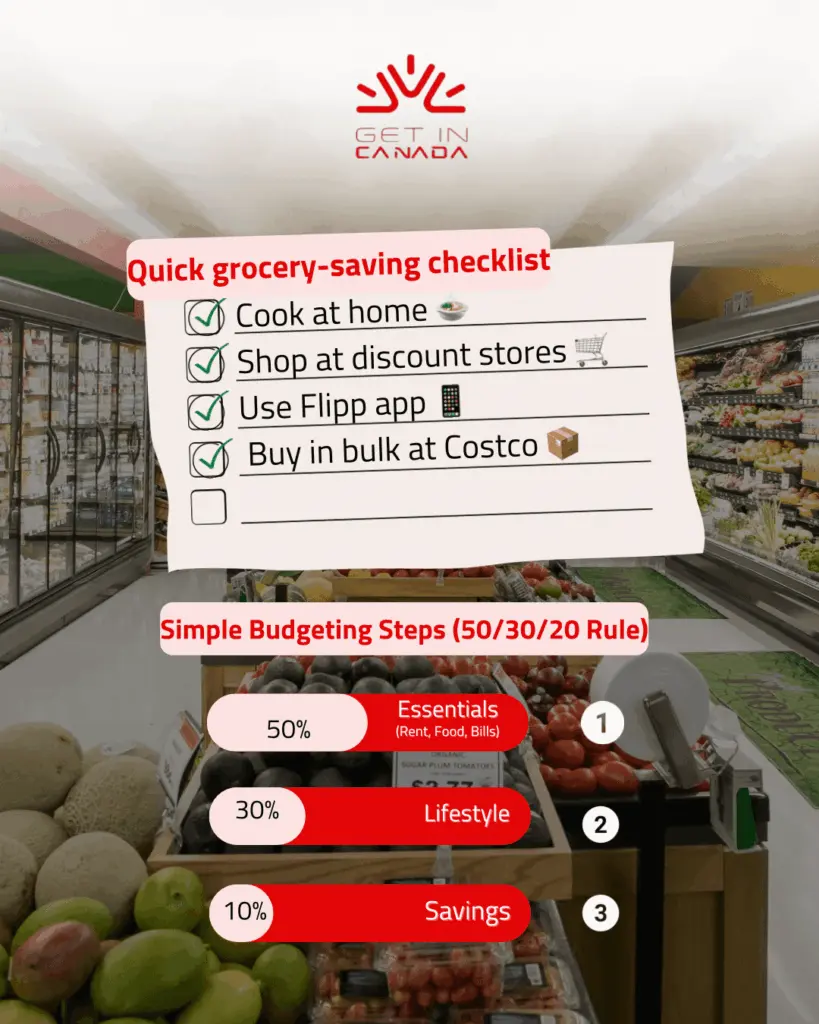

3. Saving on Food and Groceries in Canada

Food is one of the most common budget struggles. Newcomers quickly realize that eating out daily is unsustainable. To save money groceries Canada, focus on cooking at home and shopping smart.

Strategies for cheap food Canada students should try:

- Shop weekly at discount chains like No Frills, FreshCo, or Walmart.

- Use flyers on Flipp to spot discounts.

- Buy in bulk at Costco for shared living situations.

- Cook large meals and freeze portions to save both time and money.

- Explore ethnic grocery stores; they often have cheaper produce.

On average, students spend CAD 250–400/month on groceries. By meal-prepping, this can drop closer to CAD 200.

Read More: Top 10 Affordable Grocery Stores in Canada

➡️ Now that we’ve covered food, let’s look at how to cut transportation costs.

4. Transportation Discounts for Students and Newcomers

Getting around in Canada is easier with public transit, but fares can add up. Many cities offer student transportation discount Canada programs, making it more affordable for newcomers.

Examples of student transit savings:

- Toronto: TTC Post-Secondary Discounts

- Vancouver: Compass Card U-Pass

- Montreal: Reduced-fare Opus cards

Cost Comparison (Monthly Passes):

| City | Regular Adult (CAD) | Student Discount (CAD) |

|---|---|---|

| Toronto | 156 | 128.15 |

| Vancouver | 105 | 45 (U-Pass) |

| Montreal | 94 | 58.50 |

Extra transportation tips:

- Consider buying a used bicycle for warmer months.

- Use ridesharing apps wisely; avoid peak times.

- If living near campus, walking can save hundreds per year.

➡️ To stay on track with all these costs, proper budgeting is essential.

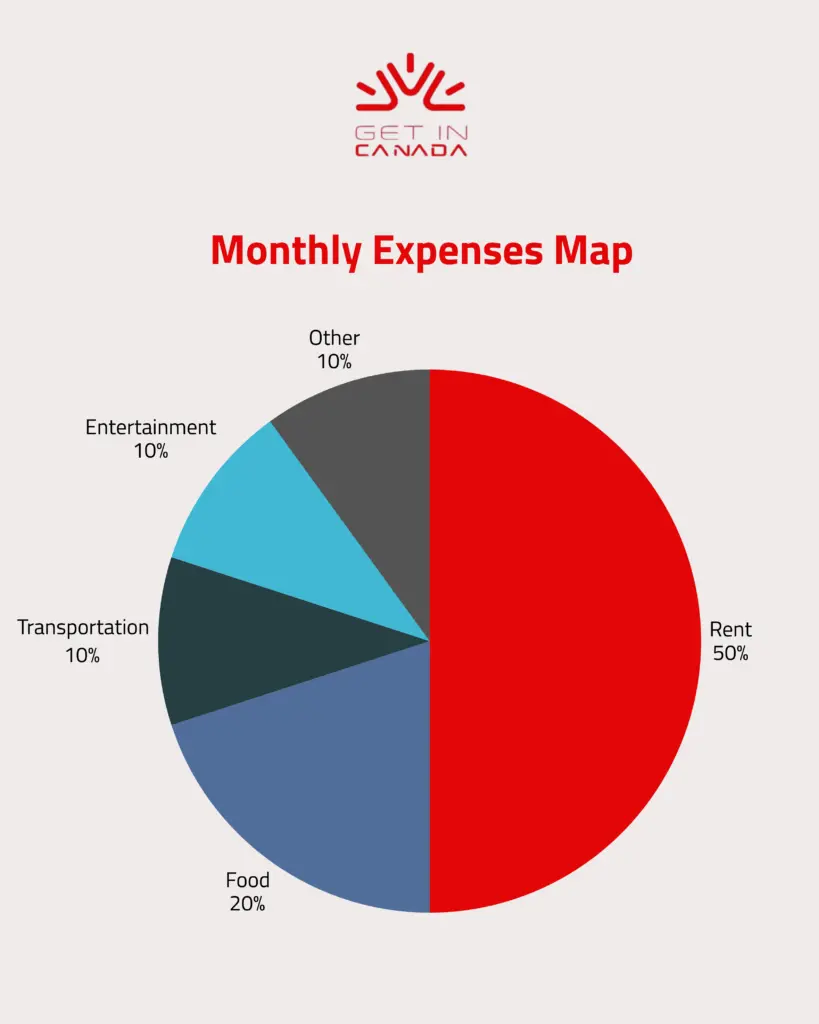

5. Budgeting Tips for International Students in Canada

Budgeting is the foundation of financial stability. Without it, even students with scholarships struggle. Using tools like Mint or YNAB helps track spending.

Suggested 50/20/30 rule for budgeting Canada students:

- 50% for essentials (rent, groceries, transit, utilities)

- 20% for savings (emergencies, tuition, future plans)

- 30% for personal (entertainment, clothes, hobbies)

Pro tip: Set aside CAD 50–100/month for “unexpected costs” like textbooks, medical needs, or moving expenses.

Related: Settling in Canada for Newcomers 2025

➡️ Even with budgeting, scholarships and financial aid can reduce pressure significantly.

Book Your Consultation Session →

6. Scholarships and Financial Aid Opportunities

Canada provides generous support for students through scholarships Canada international students and financial aid programs. These opportunities can reduce tuition and living expenses.

Where to look:

- EduCanada Scholarships

- University-specific awards (merit-based or need-based)

- Provincial aid like OSAP (Ontario Student Assistance Program)

Examples of funding:

- EduCanada: CAD 5,000–20,000 depending on the program.

- Graduate assistantships: Monthly stipends plus tuition support.

Read More: How Many Hours Can International Students Work in Canada

➡️ Scholarships help, but many newcomers also rely on part-time jobs.

7. Working Part-Time While Studying in Canada

International students with a valid study permit can work while studying Canada up to 20 hours/week during classes and full-time during breaks. This is a great way to cover international student expenses Canada and gain Canadian work experience.

Popular part-time jobs Canada students choose:

- Retail: CAD 15–18/hour

- Restaurants & cafés: CAD 15–20/hour + tips

- Campus jobs: Tutoring, library assistants, event staff

Part-time jobs not only support your finances but also build your resume for future opportunities.

Learn more: Top 5 Well Paid Part Time Jobs for International Students in Canada in 2025

➡️ By combining housing savings, grocery strategies, transit discounts, budgeting, scholarships, and part-time work, newcomers can live comfortably in Canada.

Conclusion about Save Money in Canada

Managing money in a new country may seem overwhelming at first, but with the right strategies, it becomes manageable. By focusing on cheap housing Canada students can share, learning to save money groceries Canada, and using student transportation discount Canada programs, you’ll immediately cut your biggest expenses.

Adding smart budgeting Canada students habits, applying for scholarships Canada international students, and taking on part-time jobs Canada students ensures a balanced financial plan. These choices reduce stress, increase stability, and give you the freedom to enjoy your Canadian journey.