What You Need to Know About Taxes, Healthcare, and Freelancing in Canada

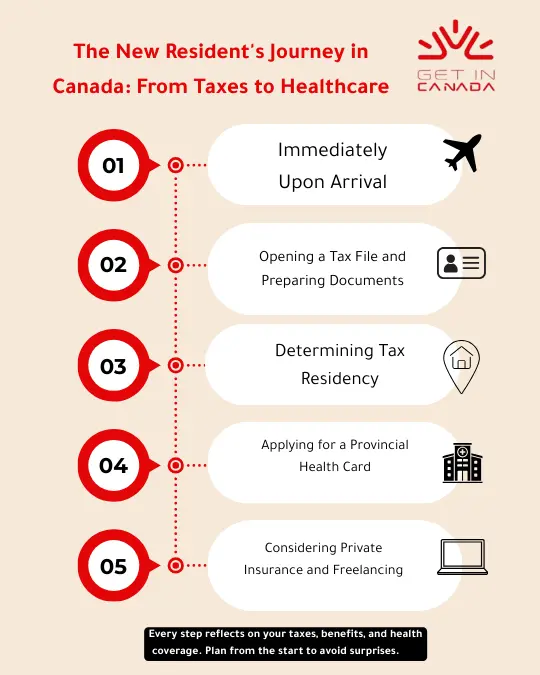

Starting a new life in Canada is about much more than getting a visa or finding your first job. Newcomers also need to understand how taxes work, how to access healthcare, and what is allowed if they want to do self‑employment or freelance work in Canada. These three topics affect your daily budget, your ability to get medical care, and the way you plan your career long‑term. This guide explains the essentials of taxes in Canada, public and private healthcare coverage, and the basic rules around freelancing and self‑employment for newcomers.

1. What You Need to Know About Taxes in Canada

Canada can be a great place to build your career or start working as a freelancer, but you need to understand how taxes in Canada work from your first year. Newcomers are often surprised by the progressive tax system, the different levels of tax, and how self‑employment income is reported.

1.1 How Income Tax Works in Canada

Canada uses a progressive income tax system, which means the tax rate increases as your income goes up. You usually pay both federal income tax and provincial or territorial tax, and the combined rate depends on where you live and how much you earn.

If you are considered a tax resident, Canada can tax your worldwide income, not just what you earn inside Canada. That is why many newcomers are advised to speak with a tax professional, especially if they still have income or assets in another country.

Example: Approximate tax impact on employment income (Ontario, 2025)

| Annual gross income | Approx. total income tax (federal + provincial) | Approx. net income after tax |

|---|---|---|

| 40,000 CAD | ~5,000 CAD | ~35,000 CAD |

| 60,000 CAD | ~9,200 CAD | ~50,800 CAD |

| 80,000 CAD | ~15,500 CAD | ~64,500 CAD |

1.2 Tax Filing Basics for Newcomers and Workers

Most individuals file an annual T1 income tax return, usually by April 30 for the previous calendar year. Filing a tax return is important even if your income is low, because it can make you eligible for benefits such as the GST/HST credit and the Canada Child Benefit.

Keeping your documents organized from day one makes filing much easier and reduces the risk of penalties or missed refunds.

You will need:

- SIN, T4 from employers, and records of any self‑employment or foreign income.

- Progressive tax: Higher income = higher tax rate.

- Two levels: federal tax + provincial/territorial tax.

- Residency: Tax residents may be taxed on worldwide income.

1.3 Taxes for Self‑Employed and Freelancers in Canada

If you do self‑employment in Canada as a freelancer, contractor, or small business owner, you normally report your business income and expenses on form T2125 with your personal tax return. You pay income tax on your net profit (income minus reasonable business expenses), and you are also responsible for both the employee and employer portions of Canada Pension Plan (CPP) contributions on that profit.

For self‑employment in Canada, keep this simple checklist:

- Report business income/expenses on T2125 with your tax return.

- Pay income tax on net profit (income – expenses).

- Pay full CPP on self‑employment income (employee + employer share).

- Register for GST/HST if your taxable supplies exceed 30,000 CAD/12 months.

Book Your Consultation Session →

2. Healthcare in Canada: What Newcomers Need to Know

Understanding healthcare in Canada is essential, because coverage is not exactly the same for every newcomer. Canada has a public health system funded by taxes, but each province and territory manages its own health insurance plan

2.1 How the Public Healthcare System Works

- Public system is tax‑funded and managed by each province.

- Usually covers:

- Family doctor visits.

- Hospital and emergency care.

- Usually does not fully cover:

- Dental, vision, many prescriptions.

2.2 Health Coverage for Permanent Residents and Work Permit Holders

Permanent residents are generally eligible to apply for public health insurance in the province where they live, but some provinces have a waiting period of up to three months before coverage starts. During this time, newcomers are strongly encouraged to get private health insurance to protect themselves from unexpected medical costs.

Some temporary residents, such as certain work permit holders and international students, can also qualify for provincial health coverage if they meet the local residence and permit conditions. Others may only be covered by their school insurance or need to purchase private health plans.

Typical pattern for PR and workers (varies by province)

| Status | Eligible for public health? | Possible waiting period |

|---|---|---|

| Permanent resident | Yes, in your province of residence | 0–3 months in some provinces |

| LMIA‑based worker | Often yes, if staying long enough | Sometimes 0–3 months |

| International student | Sometimes yes via province or school plan | Depends on province/institution |

2.3 Why Newcomers Should Consider Private Health Insurance

Private health insurance helps cover gaps that public plans do not fully include, such as dental, vision, many prescriptions, and paramedical services. It is especially important during any waiting period before your public coverage starts or if your status does not make you eligible for a provincial plan yet.

Many employers in Canada offer group benefit plans, which can significantly reduce your personal cost for extended health and dental coverage. Freelancers and self‑employed workers, on the other hand, usually need to buy their own private insurance or join association plans.

3. Self‑Employment in Canada: Freelancers, Contractors, and Small Business Owners

Self‑employment in Canada is increasingly popular among newcomers who want flexibility, especially in online work and consulting. However, being self‑employed comes with extra responsibilities related to taxes, legal structure, and compliance with your immigration status.

3.1 What Counts as Self‑Employment in Canada

The Canada Revenue Agency (CRA) looks at multiple factors to determine if you are really self‑employed or actually an employee, which can affect how taxes and payroll are handled. Misclassification can lead to penalties for both the worker and the client or company.

You are likely self‑employed if:

- You control your schedule and methods of work.

- You use your own tools/equipment.

- You can make a profit or suffer a loss from your activity.

- You invoice clients instead of being on payroll with deductions.

3.2 Tax and Legal Responsibilities for Freelancers

Freelancers should keep clear records of all income and business expenses, including invoices, receipts, and bank statements. Many choose to open a separate business bank account and use simple bookkeeping software to stay organized.

From a legal perspective, you can operate as a sole proprietor under your own name, register a business name, or set up a corporation, depending on your risk and long‑term plans. Each structure has different implications for tax, liability, and access to business immigration programs.

Quick compliance checklist for freelancers in Canada

- Choose your structure:

- Sole proprietorship.

- Partnership.

- Corporation.

- Keep:

- Invoices, receipts, contracts, bank records.

- Watch for:

- GST/HST registration threshold.

- CPP contributions and tax instalments.

3.3 Can You Freelance on a Work Permit or Study Permit?

You must always respect the conditions of your permit or status. Some work permits are employer‑specific, which means you are only authorized to work for the particular employer named on the permit and cannot legally work as a freelancer for others.

Other permits, including certain open work permits and some study permit conditions, may allow a mix of employment and limited self‑employment, but it is essential to check the exact rules that apply to your category. When in doubt, newcomers should seek legal advice before starting freelance work in Canada.

Breakdown:

- Employer‑specific work permit → generally no freelancing for others.

- Open work permit → more flexibility, but still must follow conditions.

- Study permit → limited work hours and rules; some self‑employment may not be allowed.

4. Self‑Employed Visa” in Canada: What Is Really Available?

Many people search for a self‑employed visa Canada, but in reality there is no generic freelance visa for Canada similar to some digital nomad visas in other countries. Instead, there is a specific Self‑Employed Persons Program and various business immigration options that target certain types of applicants.

4.1 The Federal Self‑Employed Persons Program

The federal Self‑Employed Persons Program is a permanent residence program designed mainly for people with significant experience in cultural or athletic activities who can make a substantial contribution to cultural or athletic life in Canada. Applicants must show at least two years of relevant self‑employment or participation at a world‑class level, along with meeting selection criteria related to experience, age, education, language, and adaptability.

Key points about the Self‑Employed Persons Program

- Type: Permanent residence, not a temporary work visa.

- Target group:

- Cultural workers (artists, writers, performers).

- Athletes and related professionals.

- Requirements:

- At least 2 years of relevant self‑employment or world‑class participation.

- Points for age, education, language, experience, adaptability.

This is very different from simply doing freelance online work, and it is not a general route for typical freelancers or small business owners. Many regular freelancers will find that Express Entry or other economic immigration streams are more realistic options.

4.2 Limits and Recent Changes to Entrepreneur Pathways

Canada has been reviewing and adjusting several business immigration pathways, including programs for entrepreneurs and start‑ups. Recent updates include the closure or redesign of some federal entrepreneur options and plans for new pathways to permanent residence tailored to innovative business owners.

Because rules can change quickly, anyone considering business or self‑employed immigration should use up‑to‑date official information and, ideally, professional advice. Misunderstanding the requirements can lead to refused applications and lost time.

4.3 Alternatives to a “Freelance Visa” in Canada

Instead of looking for a “freelance visa,” many self‑employed people consider more established routes such as:

- Common alternatives:

- Express Entry (FSW, CEC).

- Provincial Nominee Programs (skilled worker & entrepreneur streams).

- Employer‑sponsored work permits → then PR later.

- Start‑up and innovation routes in certain jurisdictions.

Book Your Consultation Session →

5. General Work Permit Requirements in Canada

Understanding work permit requirements in Canada is essential, even if your long‑term goal is to work as a freelancer or become self‑employed after you arrive. Work permits are typically temporary, but they can be an important step toward permanent residence.

5.1 Basic Eligibility for a Canadian Work Permit

Most employer‑specific work permits require a valid job offer from a Canadian employer and, in many cases, a Labour Market Impact Assessment (LMIA) or an LMIA‑exempt category. Applicants must usually show a valid passport, prove they will leave Canada at the end of their authorized stay, and demonstrate they have enough funds and no serious criminal record.

Medical exams are required for certain occupations and stays over a specific length of time, especially if the job involves healthcare, childcare, or education. Providing complete and accurate documentation is critical to avoid delays or refusals.

5.2 Employer‑Specific vs Open Work Permits

An employer‑specific work permit limits you to working for one employer, in one occupation, and sometimes in one location in Canada. To change jobs, you normally must apply for a new permit or modify your existing authorization.

Open work permits allow you to work for almost any employer in Canada, with a few exceptions, and are often granted to spouses of eligible workers or students, certain applicants in the permanent residence process, or under special public policies. Open permits offer more flexibility, including better options to move into self‑employment after arrival, as long as you respect the rules of your status.

| Feature | Employer‑Specific Work Permit | Open Work Permit |

|---|---|---|

| Employer | One named employer only | Any eligible employer |

| Job flexibility | Very limited | High |

| Typical use cases | LMIA‑based jobs, intra‑company, etc. | Spouses, some PR applicants, special policies |

5.3 Common Mistakes When Applying for a Work Permit

Frequent mistakes include submitting incomplete forms, choosing the wrong NOC code, failing to prove that you meet the job requirements, or not addressing ties to your home country when required. Another common issue is ignoring new rules at ports of entry and assuming that all nationalities can apply on arrival, which is not always true under the 2025 updates.

Breakdown:

- Incomplete or inconsistent forms and documents.

- Wrong NOC or weak proof of qualifications.

- Misunderstanding 2025 rules for applications at the port of entry

Staying informed about recent changes and checking official IRCC instructions before applying can help you avoid many of these problems.

Conclusion

depends on more than just securing a work permit or permanent residence. Understanding how Canadian taxes work, when and why to file a return, and how self‑employment income is treated helps you avoid costly mistakes and plan your finances better. Knowing how the healthcare system operates, including possible waiting periods and the limits of public coverage, allows you to protect yourself with the right mix of public and private insurance. Finally, if you are interested in freelancing or running your own business, you must always respect the conditions of your status and choose a legal path that fits your profile. With the right information, you can build a safer, more stable future in Canada for yourself and your family.

For more Canadian visa inquiries? Click here to start the process with our help →

FAQs About Taxes, Healthcare, and Self‑Employment in Canad